Digital accounting

Can understanding accountant’s key needs

and responsibilities help with low uptake

of features?

August 2022 - Jan 2023

DIGITAL ACCOUNTING

Can creating smarter tables help a

Neo-bank’s users work faster?

August 2022 - Jan 2023

Role | UX Researcher, Product Designer

Company | Aspire (Digital Finance management tool)

Outcome | Conducted user research with 11 accounting firms, suggested feature and user flow changes and revamped the accounting integration feature. There was a 15.08% increase in the number of businesses that connected with Xero on Aspire in the next 6 months.

Methods | Interviews | Purposive sampling | Usability Testing | Information architecture | User flows | Wire framing | Prototyping |

Interface Design

DASHBOARD OF ACCOUNTING INTEGRATION WITH ASPIRE BEFORE REVAMP

the what ?

defining objectives

As part of the Accounting product team, I built advanced features for integrations with accounting software (like-Xero). The leading reason for this was to attract larger businesses that need more support with integrations.

However, there appeared to be a very low uptake of features released. To investigate this as a team we decided to research and develop a clear understanding of accountant’s real needs, so we can build workflows of significant impact.

We interviewed 13 businesses including accounting firms and accounting software companies.

key questions

-

What are the accounting needs of a business?

-

What are an accountant’s key responsibilities?

-

What accounting support/features we need on Aspire?

“Why do we need both Aspire and Xero? I am concerned about duplication of effort.” - Common User Concern

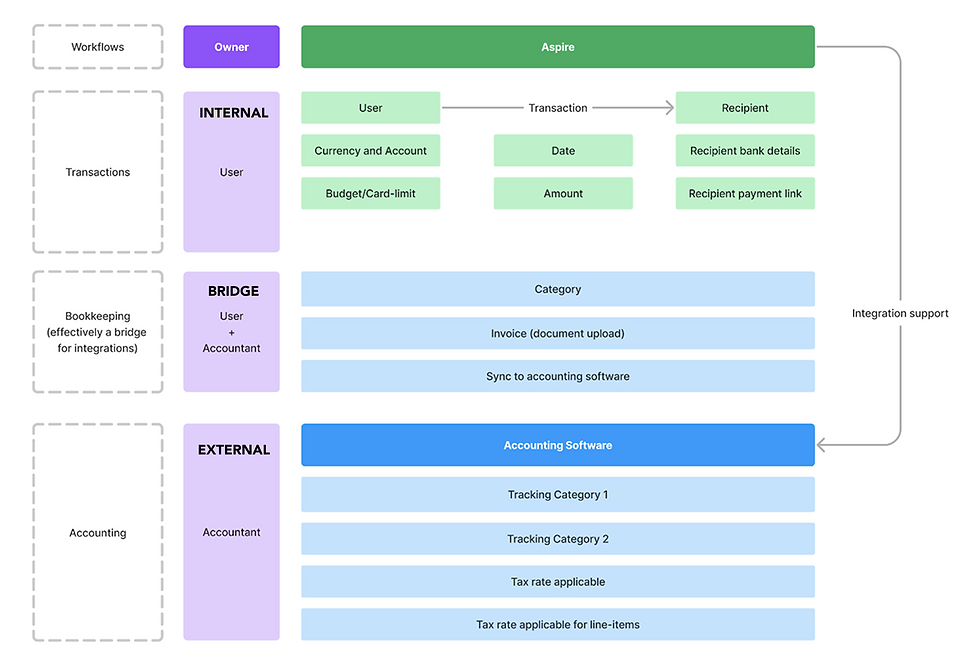

ANALYSING HOW ACCOUNTING INTEGRATION CAN BE AN EFFECTIVE BRIDGE BETWEEN ASPIRE AND ACCOUNTING SOFTWARES

the why ?

IDENTIFYING USER CONCERNS

The diagram above shows the break-up of data points and processes mapped to respective owner. This distinction was crucial in making decisions about weather a feature/action/workflow is required at Aspire’s end, or if it is better performed in the accounting software of the company’s choice.

Let accountants do their accounting on specialised accounting softwares and Aspire can build support by focussing on simplifying data gathering and classification. - Top Insight

THE RESEARCH REPORT (PLEASE SCROLL TO VIEW MORE)

.png)

REVAMPED DASHBOARD OF ACCOUNTING INTEGRATION WITH ASPIRE

the how ?

IMPLEMENTING seamless workflows

The new feature focussed on at syncing data seamlessly and simplifying reconciliation for the accountants instead of creating another complex accounting software.

-

Now the users were able to approve the bills, make the payment and sync the bills to Xero all from one place (Aspire) for simple reconciliation.

-

Optical Character Recognition (OCR) was added on Aspire which eventually reduced the manual entry of data into Xero.

-

Regular reminders to attach documents to bills was automated to reduce the work of accountants.

the impact

measuring success

The following are the metrics post the launch of the product from Aug 2022- Jan 2023

-

Percentage increase in the number of business that have connected to Xero in past 6 months: 15.083%

-

Percentage increase in bills synced in past 6 months: 30.975%